Get to the root of the fraud problem.

No matter how much is being spent on cybersecurity and fraud prevention, ATTACKERS MANAGE TO STILL GET THROUGH. The root of the problem begins with how personal data is stored and managed. Personal data is stored in central honeypots and we allow that data to be used for account access. From setting up an account with social security numbers, to retrieving funds and conducting transactions with usernames and passwords — the circle of identity is broken.

Your customers rely on you to keep their accounts out of the reach of hackers.

Because of privacy and data concerns, the one data point that can ensure a person is who they claim to be, that is, a biometric, is often not utilized. In addition, identity management processes are completely disjointed, and this is what hackers exploit.

Think about how your customers currently interface online, at the contact center, with chat channels, even in the branch:

- With a reliance on outdated and unsafe use of passwords for authentication

- Where fraud detection relies on reactive protocols that occur after the fact

- And security and backup protocols that can expose personal data

- All while generating unnecessary friction for consumers

And that’s why we’ve designed our products with the privacy, security and the end to end user journey in mind.

Consider the status quo. It is time for change and to build financial services based on trusted identities.

- 59% of identity fraud victims experienced total account takeover in 2021.

- Identity fraud whereIdentity fraud where criminals opened a new account using a person’s PII affected 4.9 million victims in 2021. criminals opened a new account using a person’s PII affected 4.9 million victims in 2021.

- Identity fraud involving existing checking, savings, insurance or other accounts increased73 percent from 2020 to 2021 and totaled $7.8 billion.

- Fraud involving existing credit cards increased 69 percent and cost consumers an estimated $9.3 billion.

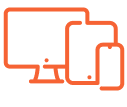

Implementing the Anonybit Genie for Financial Services

We enable consistent biometrics to be leveraged across the entire customer journey, regardless of service channel.

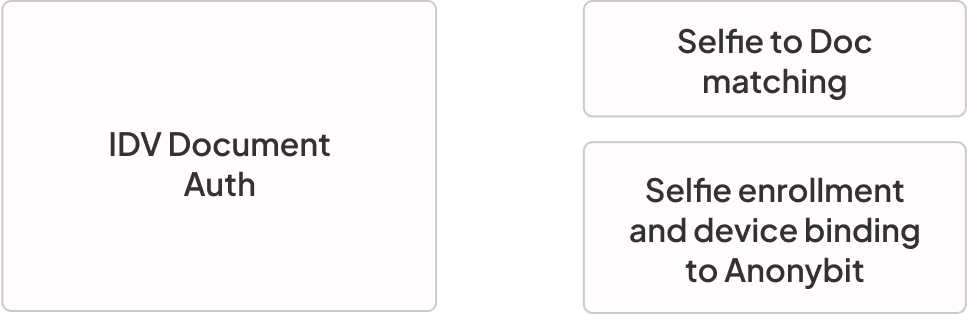

Digital Onboarding

User enrolls to online service following standard IDV/AML/KYC protocols.

Biometric Registration

User selfie gets ingested into the Anonybit decentralized cloud.

Authentication

User accesses account using Anonybit biometric MFA.

Account Recovery

User steps up to the Anonybit decentralized cloud for added protection.

The Anonybit Genie solves acute identity management problems that today's Financial Services face.

Passwordless Biometric Authentication

- State of the art biometric algorithms with built-in liveness detection ensures people are who they claim to be

- Persistent use of the biometrics captured at digital onboarding in downstream applications prevents attackers from exploiting gaps and using stolen data to impersonate people

- Single, modular platform supports a variety of use cases including synthetic identity checks, FIDO support, contact center authentication and more

Decentralized Biometrics Data Storage

- Patent-pending technique eliminates the need for storage of biometric templates, reducing data protection risk and enhancing compliance with privacy regulations

- Backend support for third-party biometric algorithms including 1:1 and 1:N matching, as well as any other PII that is collected as part of the digital onboarding process

- Built-in to the Anonybit Genie for turnkey implementation via APIs, SDKs and SAML integrations

The Anonybit Genie provides unparalleled benefits for Financial Services

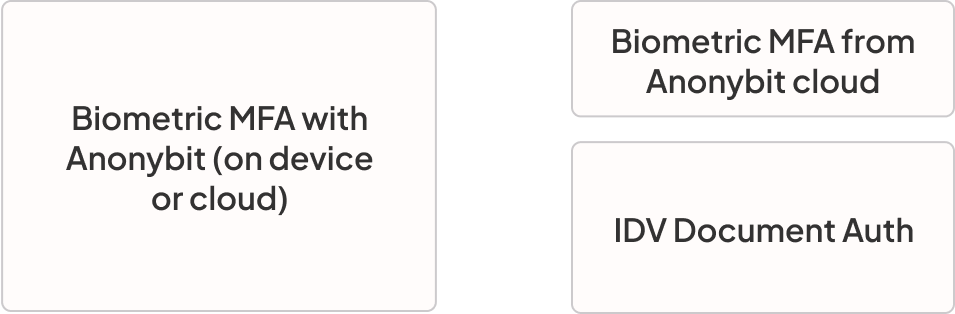

Device Independent

Works across devices. Not susceptible to device takeover, unlike traditional solutions that fall back to PINs, and KBA.

Privacy-By- Design

No central honeypots for maximum data protection. Nothing for hackers to find and nothing for hackers to steal.

Multiple Use Cases

Supports all modalities and third party-algorithms for different identity management needs across the enterprise.

Closed Circle of Identity

Connects onboarding to access and account recovery to close the gaps exploited by attackers in the authentication process.

Resources on Enabling Strong Authentication and Biometric MFA for Financial Services

We work with our partners to enable privacy-by-design solutions.

- Leverage our decentralized biometrics cloud to create a privacy-by-design solution that helps your clients comply with the latest data protection regulations.

- Integrate our turnkey passwordless authentication platform to enable the circle of identity and close the gaps across all customer service channels that attackers exploit.

- Eliminate central honeypots and the tradeoffs that are typically made between privacy, security, user experience and cost with an off-the-shelf solution that addresses privacy and data protection head on.

It’s time to secure your Banking and Fintech applications with Anonybit.

- Offer passwordless authentication with built in account recovery to ensure people are who they claim to be across all service channels - digital, physical, chat, contact center

- Avoid central honeypots of biometrics and other personal data while maintaining full regulatory compliance

- Eliminate cost and friction around password and account resets, fraud management and data protection.

Fill out the form to the right and get in touch with our solutions team today.